New Zealand startup RIP Global is among eight companies to be selected for the next women-only Springboard Enterprises Australia (SBE) accelerator programme.

SBE Australia, a not-for-profit with the first female-only startup accelerator in Australia, lead successful businesses in industries including healthtech, agritech, real estate, wellness and fashion.

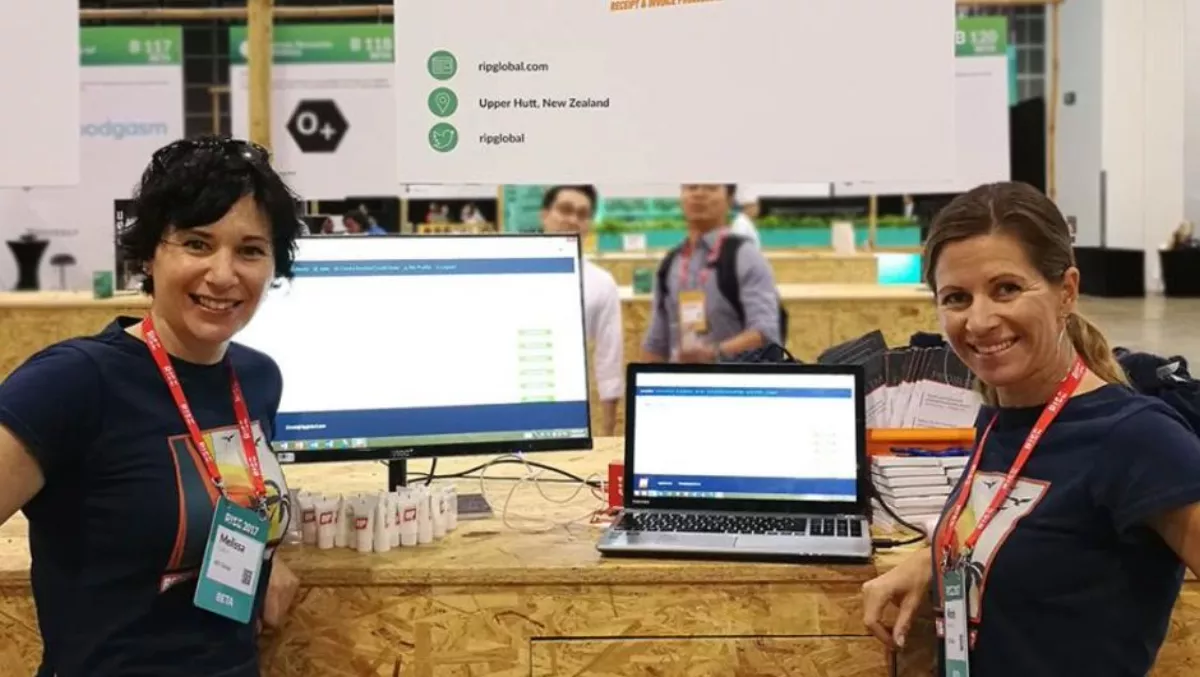

RIP Global was founded by Mel Gollan in Wellington to take the hassle out of invoicing and the collection of receipts, FinTechNZ general manager James Brown says.

RIP Global is a cloud-based expense reporting and bookkeeping solution. The service eliminates the need for scanning and uploading receipts and holding onto paperwork.

Instead, it starts tracking and reconciling expenses as soon as a purchase is made and reconciles invoices directly with bank account statement data.

“Recently they were selected by the Department of Internal Affairs to be part of the NZ government marketplace for cloud services beta test programme, helping to make New Zealand become a real digital nation.

“Startups contribute AU$164 billion to the Australia economy and fintech is growing annually by 48.5% here in New Zealand. Tech will become New Zealand's second largest contributor towards GDP, probably before 2025,” Brown says.

“Some of the growth is coming from programmes like the Kiwibank accelerator now in its second year. We have also seen companies like investment organiser Sharesies achieve $1 million in investments and 5000 users in just eight weeks. They reached full funding within four weeks before the programme's investment showcase demo day.

“Accounting Pod and Tapi (formerly Flatfish) achieved full funding and are on track to crack $1 million annual revenue targets.

“Kiwi companies are obtaining global reach with both Vallum and InsuredHQ being invited to attend and present at the Global insuretech roadshow in Frankfurt. Twenty-four companies pitched for the Goethe insuretech award including both NZ companies.

“There is growing global interest in New Zealand tech and delegations from the biggest fintech hubs in the world such as the United Kingdom and Singapore are visiting New Zealand.

“With Techweek just around the corner New Zealand has another great opportunity to continue to connect, promote and advance opportunities for companies in the tech ecosystem and I am looking forward to another successful national fintech conference later in the year were we will celebrate our success.

Brown says fintech is a rapidly growing part of the New Zealand tech scene with an ever increasing number and quality of fintech startups.