New Zealand retail software provider Vend and Australian retail payments platform Afterpay today announced a joint solution for independent retailers in New Zealand and across the ditch.

Vend and Afterpay will enable SMB retailers to offer the alternative payment option in-store, opening up an entirely new selling channel.

Afterpay's buy now, pay later solution is used by over 14,000 merchants in Australia and New Zealand, across a number of large-scale bricks-and-mortar stores, as well as online retailers of various sizes.

In high demand, Afterpay has processed payments for over 1.8 million customers.

Until today, a solution was unavailable for independent and smaller retailers to offer the Afterpay payment option within their physical stores.

This has put them at a disadvantage when competing with big-box retailers for customer share.

Afterpay now is integrated with Vend's point-of-sale (POS) software.

Businesses using Vend can set up and offer Afterpay to their customers in-store, allowing independent retailers to compete with larger stores and help SMEs increase sales and repeat customers.

Vend Australia and New Zealand country manager Dave Scheine says, “At Vend, we want to level the playing field for independent retailers, and give them access to the same tools the big stores have.

“That's been our mission from day one. So we're really pleased we can now offer Afterpay to our bricks-and-mortar retailers, to help them create a modern, attractive shopping experience for their customers.

“And it's really exciting for us as a company. Buy now, pay later is a fast-growing and popular way to pay that's only going to get bigger. It's something our retailers need to be offering, which means we need to be providing it for them.

Afterpay sales director Fabio de Carvalho says, “We're incredibly excited and pleased that we can now offer thousands of small businesses the ability use Afterpay in-store.

“Vend's intuitive, sophisticated software is the perfect platform to take Afterpay out to New Zealand's independent retailers. Retail merchants can now benefit from the boost in sales that many are already experiencing with Afterpay online.

Wellington retailer Empire Skate and Street is one of the initial customers to pilot the new integration with Vend.

“We are really excited Afterpay is now available, online and in-store. We know it'll help us offer our customers an even better experience,” says Empire Skate and Street director Matt Wells.

“We can't wait for our customers to come in-store and be able to use this new payment option.

Afterpay, which first launched in New Zealand six months ago, allows customers to buy in-store instantly, putting down a quarter of the cost and paying over four equal fortnightly instalments.

It offers the benefits of a layby service with an immediate take-home option.

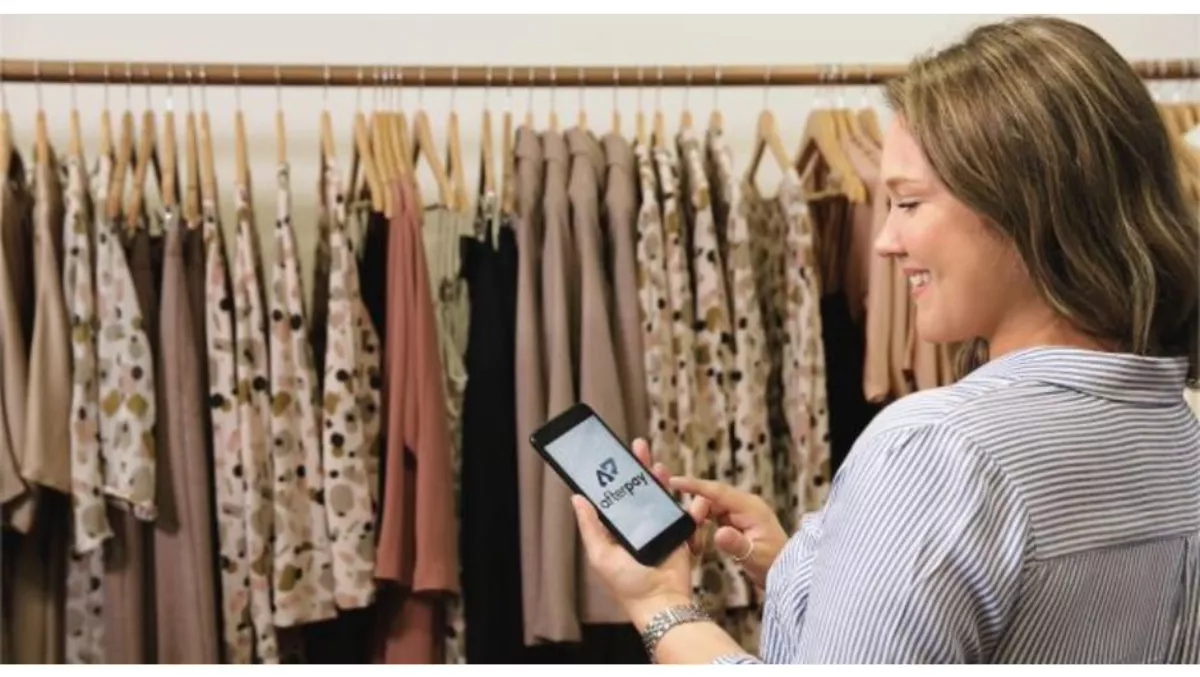

To make a sale with Vend's POS, retailers scan the customer's unique Afterpay barcode via a mobile device and the payment feeds straight into Vend, keeping the check-out process quick and seamless for both retailer and shopper.

Afterpay will be available to all New Zealand retailers using Vend from today.