Xero and Stripe have partnered to help small business owners get paid faster, today announcing an expanded online payment solution with automated reconciliation.

The integration gives Xero's more than one million subscribers a greater choice of payment services, more cash flow control and enhanced efficiency through automation.

The Stripe reconciliation functionality means when a Stripe payout comes in through a bank feed, Xero will do the matching work.

All the transactions in Xero are tied to the Stripe statement line and will be automatically matched against it so they can be reconciled with just one click.

Xero can automatically match multiple transactions to a statement line, identifying payments and fees associated with their corresponding Stripe payout.

Additionally, if there is a difference between the payout amount from Stripe and the total found in Xero, Xero will still find all the relevant transactions and bring them back as a partial match.

“We're constantly focused on designing beautiful experiences and automating as many manual processes as we can,” says Craig Walker, Xero chief technology officer.

“Last year, Xero began automating Stripe fees, and now we've completely automated the matching work, eradicating what was a largely manual process to reconcile payments.

We're thrilled to partner with Stripe to deliver seamless online payments for our mutual small business customers.

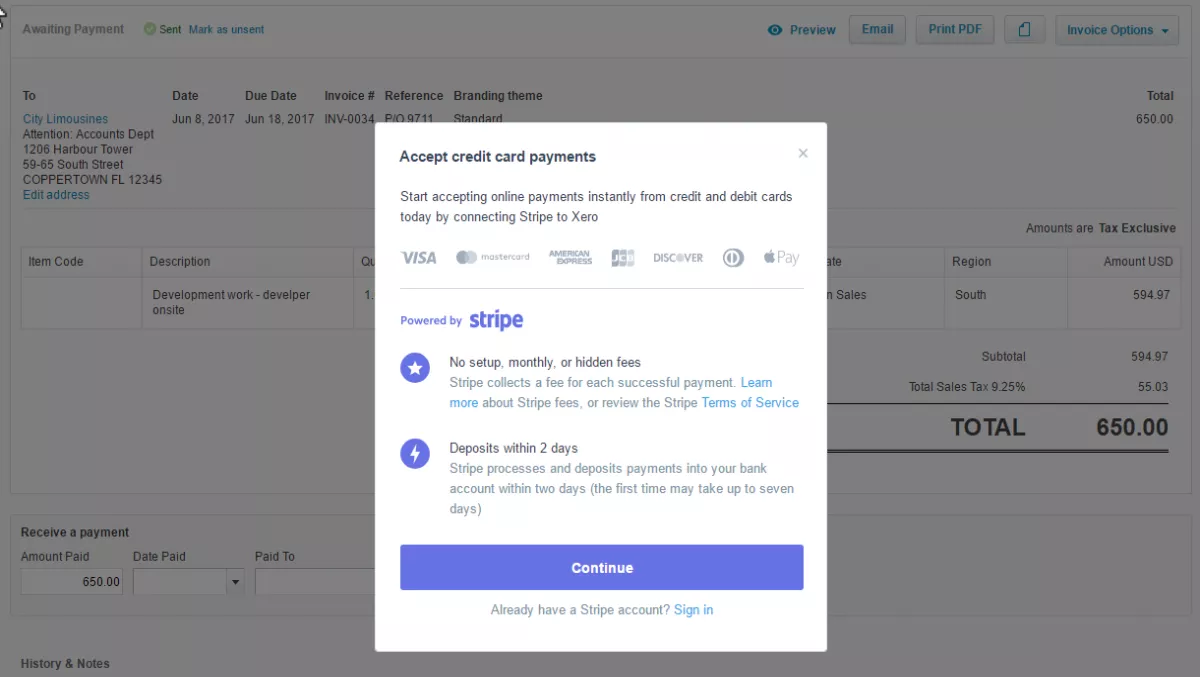

The simple setup process enables small business owners to quickly begin accepting credit card payments for online invoices, giving a small business owner more ways to get paid faster.

“Our goal is to make getting paid with Stripe as smooth an experience as possible so you can spend less time chasing payments on outstanding invoices and more time growing your business.

“We're also trying to look at ways we can improve your cash flow, and we're working hard to bring you more innovations in this space,” Walker says.

Cristina Cordova, Stripe business development head, says sinking resources into needlessly laborious tasks isn't a good use of time for any small business.

“We continue to develop tools and features that make starting and scaling an internet business easier, and we're excited to work with Xero to simplify payment reconciliation for our users.

Payments in the financial web

Working with more than 140 financial institutions around the world, Xero is increasing its focus on partnering with financial services to collaborate on innovation and data share standards, helping to open up capital for small business owners and create new ways for them to get paid faster.

More than $1.4 trillion worth of incoming and outgoing transactions were processed on the Xero platform over the past 12 months, a data point which Anna Curzon, Xero chief partner officer, says highlights the importance of small business in the global economy.

“The way small business owners pay for services and receive payment continues to evolve with the help of cloud technology and mobility.

"Increasingly, these entrepreneurs are using smartphones to make transactions and run their businesses."

Curzon says that by investing in building a global platform and supporting the advisors who support small businesses, Stripe is working to help these entrepreneurs reach their full potential.